Financial Planning for Homeschooling Single Parents

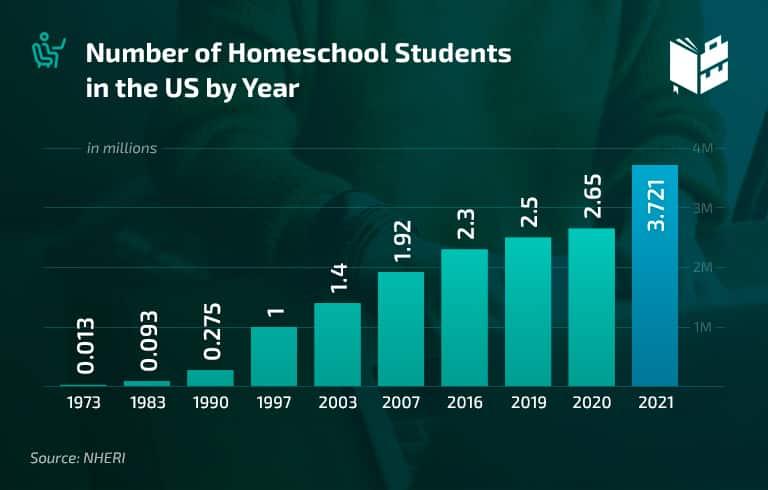

Welcome to the world of financial planning for homeschooling single parents! Gone are the days of budgeting just for school supplies and field trips – now you have to factor in the cost of textbooks, extracurricular activities, and the occasional mental breakdown (for both you and your child). But fear not, with a little bit of creativity and a whole lot of caffeine, you can navigate the murky waters of education and finances with ease. So grab your calculators and your coffee mugs, because we’re about to make budgeting fun (or at least tolerable).

Importance of Financial Planning for Homeschooling Single Parents

So you’ve chosen the noble path of homeschooling as a single parent – cheers to you! Now, let’s talk about the not-so-glamorous side of things: finances. Making sure your budget is in check is crucial for smooth sailing on this homeschooling journey. Here’s why financial planning is your new BFF:

- Peace of mind: Knowing where every penny is going will give you that warm fuzzy feeling inside. No more worrying about unexpected expenses popping up and ruining your day.

- Stress reduction: Money problems can be a major source of stress. By having a solid financial plan in place, you can kick back, relax, and focus on what really matters – teaching your little ones.

- Goal setting: Financial planning allows you to set achievable goals for your homeschooling adventures. Whether it’s saving up for a field trip or investing in new educational materials, having a plan will help you stay on track.

Remember, being a homeschooling single parent is already a tough gig. Don’t let money troubles drag you down! With a solid financial plan in place, you’ll be able to tackle any obstacles that come your way – and maybe even have a little fun along the journey.

Budgeting Strategies for Single Parents

Being a single parent is no easy feat, especially when it comes to managing finances. But fear not, dear single parents! Here are some budgeting strategies that will help you navigate the tricky waters of money management:

1. Meal planning: Save time and money by planning out your meals for the week ahead of time. Not only will this help you avoid those last-minute trips to the drive-thru, but it will also ensure that you’re not wasting money on ingredients that end up going bad in the back of your fridge.

2. DIY projects: Instead of splurging on expensive home decor or furniture, why not try your hand at some fun and creative DIY projects? Not only will this save you money, but it will also give you a sense of accomplishment and pride in your handiwork.

3. Embrace the power of coupons: Clip ’em, print ’em, and use ’em! Coupons are a single parent’s best friend when it comes to saving money on everything from groceries to clothing to entertainment. Don’t be shy about using them – your wallet will thank you later.

Maximizing Available Resources and Support

So you’ve found yourself in a pickle, trying to make the most of what ya got, huh? Well, fear not my fellow resourceful friend, for I have some tips that’ll have you maximizing those available resources and support in no time!

First things first, take a good ol’ inventory of what you’ve got at your disposal. You know, like a scavenger hunt but without the annoying clues. Look around at what you have, whether it’s a helpful coworker, a stash of office supplies, or even a vending machine full of snacks (hey, no judgement). Once you’ve got your list, it’s time to get creative!

Next up, don’t be afraid to ask for help. I know, I know, the dreaded “Can you help me with this?” might make you break out in a cold sweat, but trust me on this one. Reach out to those around you for support, whether it’s brainstorming ideas together, borrowing their expertise, or simply getting an extra set of hands to help out.

And lastly, don’t forget to utilize the power of technology. We live in a world where there’s an app for pretty much everything, so why not take advantage of it? Whether it’s project management tools, communication apps, or even just a good ol’ Google search, technology can be your best friend in maximizing those resources and support. So go forth, my resourceful warriors, and conquer the day!

Investing in Educational Materials and Activities

Are you tired of your students falling asleep during class because your current educational materials are as boring as watching paint dry? Well, fear not! Investing in new and exciting educational materials and activities is the answer to all your classroom woes. Say goodbye to yawns and hello to engaged and enthusiastic students!

With a little creativity and a sprinkle of magic (or maybe just some colorful markers), you can transform your classroom into a dynamic learning environment that will keep your students on the edge of their seats. Think outside the box and consider investing in:

- Interactive whiteboards: Say goodbye to dusty chalkboards and hello to a whole new world of interactive learning.

- Hands-on science experiments: Who needs textbooks when you can blow stuff up (safely, of course) in the name of education?

- Field trips: Because sometimes the best classroom is the great outdoors (or the local museum, that works too).

So what are you waiting for? Time to put on your thinking cap, crack open that piggy bank, and start that will spark a love for learning in your students. Trust us, they’ll thank you for it (or at least stop falling asleep in class).

Exploring Opportunities for Financial Assistance

Are you tired of looking at your bank account and seeing more red than a stop sign? Fear not, for there are plenty of opportunities out there for financial assistance that can help turn your frown upside down (and maybe even into a dollar sign).

One such opportunity is scholarships. That’s right, free money just for being you (and maybe having a decent GPA or killer essay writing skills). So dust off those textbooks and get ready to hit the books (and possibly the jackpot).

Another option to explore is grants. Think of grants as the fairy godmother of the financial aid world – swooping in to save the day just when you thought all hope was lost. With grants, you could receive funding for everything from research projects to starting your own business. It’s like winning the lottery, but without having to share the winnings.

And let’s not forget about good old loans. Sure, they may not be as glamorous as scholarships or grants, but they can still be a lifesaver in times of need. Just remember, with great borrowing power comes great responsibility (and interest rates).

Creating a Long-Term Financial Plan for Homeschooling

When it comes to , you’ll want to consider all the potential costs and expenses that may arise over the years. Here are a few tips to help you navigate the murky waters of homeschooling finances:

- Figure out your budget: Take a good hard look at your current financial situation and determine how much you can realistically afford to allocate towards homeschooling expenses. Remember, it’s not just about the cost of textbooks and supplies – there may also be extracurricular activities, field trips, and other hidden costs to consider.

- Set aside an emergency fund: Let’s face it – unexpected expenses are bound to pop up when you least expect them. By setting aside a little extra cash for emergencies, you can avoid the stress of trying to scramble for funds at the last minute.

- Consider alternative sources of income: If you’re feeling the financial strain of homeschooling, don’t be afraid to get creative when it comes to bringing in a little extra income. Whether it’s starting a side hustle, selling handmade crafts, or even renting out a room on Airbnb, there are plenty of ways to pad your bank account without breaking the bank.

Remember, homeschooling is an investment in your child’s future – so don’t be afraid to splurge a little when it comes to educational materials or resources. With a solid long-term financial plan in place, you can rest easy knowing that you’re setting your child up for success without bankrupting yourself in the process.

Building a Support Network for Financial and Emotional Wellbeing

When it comes to , it’s important to surround yourself with people who can lift you up when times get tough. Here are some tips to help you build a strong support system:

- **Reach out to friends and family:** Don’t be afraid to lean on your loved ones for support. They can provide a listening ear, advice, or even just a shoulder to cry on.

- **Join a support group:** Seek out a group of like-minded individuals who are going through similar struggles. It can be comforting to know that you’re not alone in your journey.

- **Find a financial advisor:** A professional can help you navigate the murky waters of budgeting, saving, and investing. Plus, they can provide valuable guidance when it comes to managing your finances.

Remember, building a support network takes time and effort, but the rewards are well worth it. By surrounding yourself with people who care about your wellbeing, you’ll have a better chance of weathering whatever life throws your way.

FAQs

How can single parents effectively budget for homeschooling expenses?

It’s simple! Just pretend you’re a ninja with your finances. Cut out unnecessary expenses like that daily $5 fancy coffee and reevaluate your grocery shopping list. Make a budget and stick to it like glue!

What are some creative ways single parents can save money on homeschooling materials?

Get crafty, my friend! Hit up thrift stores for low-cost books and supplies, swap materials with other homeschooling families, or even borrow resources from your local library. Your wallet will thank you!

How can single parents balance work and homeschooling responsibilities while also managing their finances?

Time management is key! Set up a schedule that allows for dedicated work time, homeschooling time, and budgeting time. Make the most of every minute and you’ll be a financial planning superstar!

What are some tips for single parents to build an emergency fund while homeschooling?

Start small but stay consistent. Even if it’s just $10 a week, it adds up over time. Cut back on unnecessary spending and prioritize saving for emergencies. Remember, it’s better to be safe than sorry!

How can single parents ensure they are financially prepared for unexpected homeschooling expenses?

Be proactive and plan ahead! Set up a separate savings account specifically for homeschooling expenses and contribute to it regularly. Anticipate potential costs and have a financial safety net in place. You’ve got this!

Time to Make a Plan, Single Parent Superstars!

So there you have it, single parent superheroes! With a little bit of creativity, determination, and maybe a sprinkle of magic, you can conquer the world of homeschooling while staying on top of your finances. Remember, you’ve got this! And if all else fails, just remember that wine and chocolate can make even the toughest days a little bit brighter. Cheers to financial planning and homeschooling like a boss!